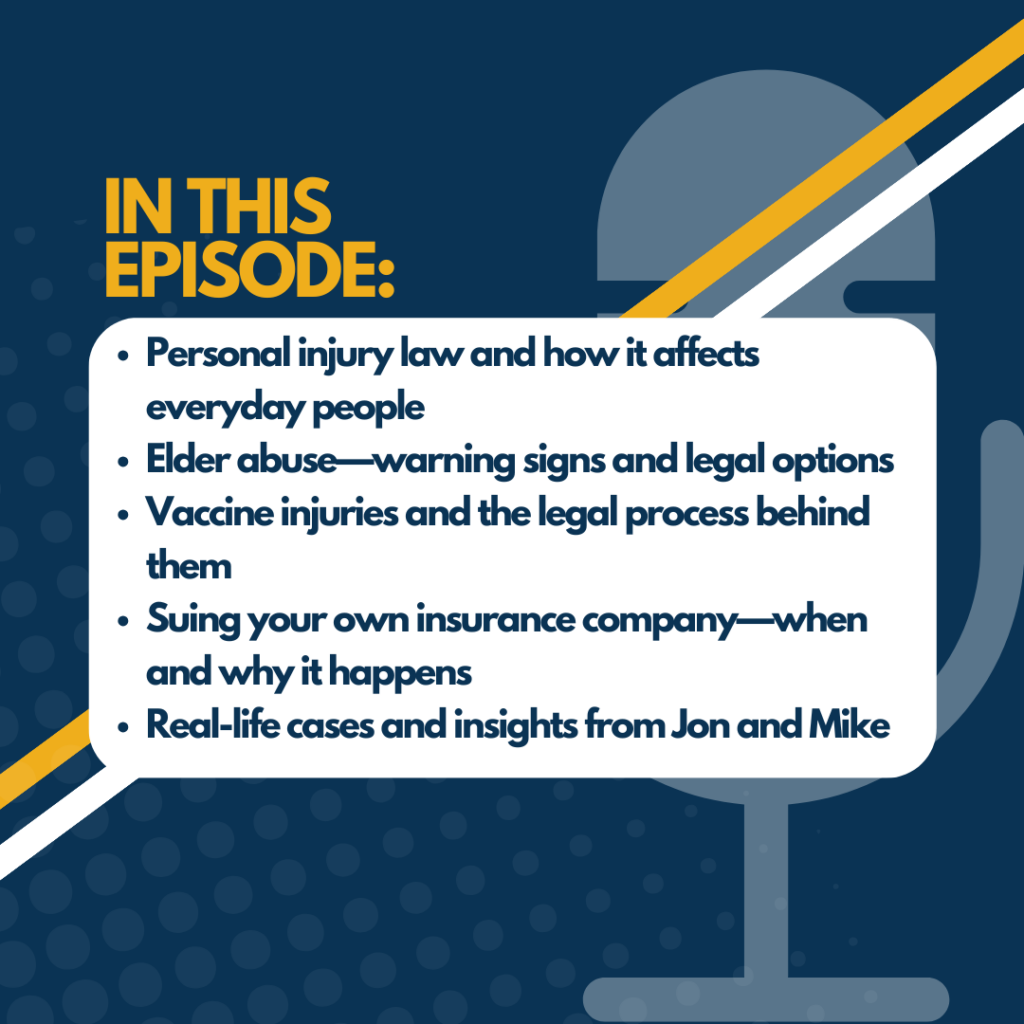

Jon Groth joins Michael Menninger on Financial Planning Explained to break down the legal side of everyday challenges — from recognizing elder abuse to navigating vaccine injury claims, and even why people sometimes have to sue their own insurance company.

It’s a must-listen for anyone looking to better understand their rights.

Want to hear all our episodes? Click here!

🎧 Listen on Spotify

🔗 Link back to the original episode

Transcript:

Welcome to Financial Planning Explained. I’m your host, Mike Menninger, certified financial planner, founder and owner of Menninger and Associates financial planning. I’m pleased to have a guest with me today. He’s an attorney. His name is Jon Groth. Owner and founder of Groth Law Firm, and what Jon specializes in is a variety of different legal stuff, but property and, personal injury and things along that nature.

So rather than kind of blow it and, and steal his thunder, because I know just reading his profile, there’s a lot of things that he is capable of doing and has the expertise in. So, with no further ado, I’d like to welcome my guest, Jon. Jon, thank you very much for joining us. Thank you for having me.

Yeah. Personal injury and all things. Personal injury is what we handle well. Yes. Good to know. Because you know what I’m gonna ask a question that I didn’t know the answer to. I think I probably do know the answer to, but I’m actually dealing with one myself. 41 years ago I had an operation and, the doctor left a piece of gauze up in my palate.

It was in there for nine months, causing enormous amount of damage. I ended up having seven different operations as a result. It’s rearing its head again. Oh my goodness. But fact is again, that’s after 41 years, there’s nothing one can do to go back. Is it signed, sealed, and delivered? It’s like a double jeopardy.

Yeah. Well, and that double jeopardy, that’s a whole different area of law that I have no clue about. But. There are certain rules, certain statutes, and I guess the legalese way is saying it is a statute of limitations and the statute of limitations in certain states could be three years.

Sometimes it’s two years. If you’re going after municipalities, it could be as little as 120 days. You know, it just depends on the state you’re in, and where the negligence took place. There’s also possibility of a thing called the discoverable or the discoverability rule. So, was the negligence discoverable at the time or is it something that it’s rearing its ugly head years later?

But even then there’s another legal term called the statute of repose. So all these things together really means Yeah, you’re out of luck. Sorry. So, I guess what I mean by, I guess, let me rephrase my question. If in fact I did, successfully win a lawsuit and then all of a sudden, you know, whatever the, whatever the situation may be.

You know, you’re injured for a particular thing. You go through the efforts, you sue, you win, and then all of a sudden a new problem or a resurgence of the existing injury comes back. Is it Sue? Once and done? You have to include everything that first time. Okay. If you don’t, you are SOL. Yeah.

Yeah, you are. Well, it raises another question. I have a friend and client. Who was in an automobile accident and really jacked her up pretty well, and it generated a lot of questions that I figured, Hey, I’ve got you here. I might want to ask, so for starters, I think she’s disappointed with how it’s going.

And because of that, does she have the ability to switch lawyers midstream or does there come a point in time that it’s no longer makes sense to do it? What? What’s your thought on that? Sure. So, so the rule is that the file is the client’s, so the client can take that bundle of documents. You know, yu say, or look at the old, old way of doing things.

You look at a actual file in a filing cabinet, and that client can take that and take that bundle of papers to any law firm that that person wants to go to. So at any point in the process, you can move. Oh really? When I started my practice in 2010, I had left another firm and my, my theory was that my business plan was that I was gonna go and I did with a bunch of different lawyers in the area and said, I don’t care at what stage of the case it is, it could be five weeks before trial.

You can get me on board and I will, you know, take it to the end and I will try the case. So that’s certainly possible. It’s not the best situation because you may not be able to find, an attorney who wants to take on the case at that stage, right? So it might be more difficult, but that’s why it’s important when you first start the process to know which questions to ask and understand which lawyers you’re looking at and whether they can take the case from the beginning until the end.

Well, and, and I suspect that it’s a business decision that you make as an attorney. You know, if you look at a case. You know, and if it’s a contingency, whether it be 33%, 40%, whatever the number might be, if you look at the case and say, well, I’m gonna need to spend a hundred hours on it and it’s only gonna generate a thousand dollars of revenue, then it’s something you obviously don’t take.

But now, right. What happened with I look at it though, is you never know what’s gonna happen in the future. You know, I, and the human body is a, an interesting thing, right? So. There are cases that I’ve taken that I thought were gonna be small cases and rightfully so, or hopefully so I should say, because the, the victim was not, initially, was not really severely injured.

But then something happened later on where they, there was an MRI where they found a tear and then there was surgery and that small injury became something really much different and the case changed. So, that’s. I look at hiring a lawyer, like having insurance or hiring a financial planner.

You know, you don’t know what’s gonna happen five years from now. You don’t know what’s gonna happen six months from now in your treatment plan. So if you have an attorney who can advise you and then if things go bad, then you know that you’re protected. Well, that’s what in this particular instance that I was talking about is, you know, she gave me, she alluded as to how much this case was gonna be worth.

Which raises another question because I think it was limited to how much the other insurance company had. As far as the other insured driver, or underinsured driver, what have you, it’s not generating that much revenue where the amount of money that she would receive as a settlement is barely going to pay the past doctor bills no less.

All of the future doctor bills. That seems unfair. Oh, I. The most important thing that you can take from this conversation is protecting yourself with uninsured or underinsured motorist coverage. And if you own a home or you rent having an umbrella policy on top of that, because then you are in control of what that sum of money is.

You’re not reliant on what the at-fault party has at as limits. That’s a, in Wisconsin, for example. You, you can be fully covered and I’ll do big quotation here, fully covered, but only have $25,000 in policy limits. Well, a flight for life, a helicopter coming to save your life is gonna charge about $20,000.

So it’s almost all eaten up just with that. So you need to make sure that you have the right coverage. So when, and again, this goes back to financial planning, but when you’re planning for. The what ifs in the future that you can protect yourself and be responsible yourself. because you never know who’s irresponsible and driving the car across the street.

That’s a very, very valid point. I appreciate you bringing that up because I didn’t realize that I could do that. So, if for some reason, and this is gonna get into, and I want to ask you about tort versus full tort versus limited tort as a separate question, but what you’re telling me is that if I am seriously injured.

By someone who is underinsured or uninsured that I could actually sue my own, umbrella liability protection. Right. So, so you, through your auto policy, you will have uninsured or underinsured right, that I’m aware of. Uninsured is just, if the other party, stole the car and they have no insurance or whatever it is, and they are just driving with no insurance.

Then your insurance is gonna step in the shoes of the at-fault party. And then I think that’s significant because then you are adverse to your own insurance because they are standing in the shoes of, right? That’s correct. I’m assuming my own insurance company, they ultimately will have the option of paying out to the victim to you, and then they have to be adverse because they’re going to try to go after, hopefully they will just for responsibility’s sake.

Go after the at fault party and maybe garnish that person’s wages or go after their assets to get that sum of money back. They’re trying to recover there. Industry and the law, there are subrogation attorneys and subrogation companies that do only that. Interesting. So, I mean, obviously the insurance company, and this is what I’ve learned all the way around, insurance companies don’t like to give away money.

And so when they’re giving away their own money, they’re gonna want to try to recover it. So, but what you’re saying is that the only way is through uninsured and underinsured on your automobile policy. Correct. And, and to be honest with you, Jon, from my recollection, when you’re looking at property and casualty or your automobile policy, that usually underinsured or uninsured, motorists usually like a coverage of maybe a hundred thousand, 50, a hundred, maybe a couple hundred thousand.

With all due respect, Jon, that doesn’t go very far. Oh, not, not at all. I can, what I often say is that I’m an insurance agent’s best friend because I can give real life examples of people who are either successful executives. I could tell you a story, but one of those guys I could tell you about a woman who had horrific medical expenses.

She worked as a cashier and, changed her life. And there are two different examples there. The one person, he thought he was covered. He was a high level executive and he had $250,000 in underinsured motorist coverage. Well, in Wisconsin, in my state, you have to compare the at-fault insurance to your underinsured motorist coverage.

So the at-fault had two 50. My client had two 50 because it was equal. The law says, and I don’t agree with it, but the law says that my client was not underinsured because it’s not two 50 plus two 50, it’s two 50 compared to two 50. So the max he could get was two 50 and he had back surgeries upon back surgeries upon back surgeries that had to take place in the future, which those can, you know, a doctor can charge 70, a hundred thousand dollars.

You know, certainly. Just the surgery can be really, really expensive and then all the therapy thereafter is very expensive. So you, you know, you thought you had that you were covered with $250,000, but he wasn’t. So that’s why it’s important in that situation to, if you’re able to get an umbrella policy and have the umbrella policy tied into your underinsured motorist coverage.

Alright, so usually, sorry. So that’s what I, so if my umbrella is it an umbrella liability policy? That would do it, correct? It’s a, yes. It’s an umbrella policy. Like, for example, my, umbrella policy is on my home and I have that tied into meaning that it, matches the limits of my underinsured motorist coverage.

Interesting. So if, if my umbrella policy is a million dollars and my underinsured is two 50, now I have a million dollars in underinsured motorist coverage. 1 million not million. Two 50. It’s the higher of the two. Yeah. Well, and it depends. Insurance companies are all goofy that way with what they’ll be able to do.

And well, states also like in, you know, Georgia for example, I know this because I have a friend of mine who, you know, who’s on their practicing law. They, they can stack policies. So if you have three different cars and each one’s insured with $25,000 in coverage, you now have $75,000 in coverage if you’re involved in a car with or in a car crash with one of those vehicles.

Oh, interesting. So it is different than Wisconsin. You can’t stack well, so you also referenced, you know, the cost of that executive needing to have multiple back surgeries, etcetera, etcetera. The other thing that comes into play is. Lost wages. And, and where does that fall in that situation?

It’s, it’s sad the person had to go on. So Social security disability. Yeah. That’s unfortunate. And that was your income thereafter? That’s now this is where you go after, or, well, I say that again. I’m a good reference for insurance agents. because this is where short term disability. Long term disability.

The Atflacs of the world. Yes. So those things. All of those should apply. If you have them, you can use them in this, I guess, worst case scenario right now, I’m gonna agree with you, I’m not a big insurance person, other than the fact that it is a very important component of financial planning is to protect yourself.

And last, before we go into break, I want to ask you, while we’re on this topic, can you also talk about the difference between tort, with the full tort and limited tort? Well, full tort and limited tort, I guess I. In Wisconsin, it’s, it’s either, tort law or not, I guess contract law. So I’m not sure about the difference between full tort and limited tort.

That might be a Pennsylvania thing. Okay. When it comes to car crashes and things like that, there’s a accident that occurs and then you have a case against the At-fault party for tort law, you know, where somebody else causes negligence. You could also have a first party case, or based on contract.

And that would be, maybe that’s what you’re saying is a limited tort because you have then the case based on your contract of insurance with whichever insurance company you have. And then that carries, I guess, different standards because there’s bad faith that comes into account and they have an obligation to abide by the terms of the contract as opposed to just simply.

Tort law and whether things are proper, reasonable, you know, those kind of terms. So in other words, it wasn’t as simple of a question as I thought it might be. So, you know, for what it’s worth, I personally, and I’ve heard horror stories of someone who had limited tort, got really maimed. And was unable to sue the other person, at least then that was Pennsylvania, was unable to sue the other person.

And if they got full tort, it enabled them to sue the other person, the other insurance company, what have you, for above and beyond the limits. And you know, for me, I mean, that’s a big jump in costs, but I’m telling you I pay it. And if you can afford to pay it, do not underestimate the value of insurance.

And you know, it’s one of those things that we say, again, we’re not big insurance people other than the fact that. We recommend that people protect themselves, but nobody has ever complained by saying when they needed insurance that they were over-insured. That’s true. Jon, very true. I will be back with you in just a few moments.

Please stay tuned. We’ll be back with you after these messages.

Do you keep up regularly with your investments? Where exactly are your hard earned dollars going? Are you financially prepared for an emergency? Unlike manager, founder of Menninger and Associates financial planning, we believe that education and knowledge are powerful and we want our clients to understand why we are making the recommendations that we make.

It’s your money and you deserve to know where it’s going. Because it’s not how much you make, it’s how much you keep. So call us today to just.

Welcome back to Financial Planning Explained, and I’m here with Jon Groth, founder of Groth Law Firm, and we had a couple minutes chatting during the break here and kind of want to talk about a couple other topics between now and the end of the episode, which seems to go quickly is I wanted to talk about elder abuse.

As well as vaccine injuries, in light of, you know, all of the, vaccinations going on and people, there’s two sides of the coin, and it’s not intended to be political, but I do also have a client who was seriously injured from a vaccine from many years ago. And, you know, he was very high up the food chain at his corporation and he’s disabled.

So can you talk to us about vaccine injuries? Very, very little known. If it wasn’t for this client, I didn’t even know it existed. Please talk to me about the subject. Sure. I can tell you, I, I didn’t know it existed until just a few years ago. You know, we were lucky enough to combine with purchase another law firm, and that law firm had staff that all they did was vaccine cases.

And then when I investigated that, I had to Google and go and say, what is a flu vaccine case? So there’s, it started back in the 1980s when vaccines were, more prevalent and there was the goal to try to get more people to take them. So you’re gonna try to figure out, you know, in the government’s mind how you can make it a, a lower barrier of entry.

And, the fear of getting the vaccine, not knowing what’s gonna happen was there certainly. So 75 cents approximately of every vaccine went into this fund and there’s a vaccine injury compensation fund. It’s the program that, the vaccine manufacturers put this money in. And now I don’t know how many billions of dollars are in there, but it’s many billions of dollars are there.

And that fund is. It’s managed by the federal government. There are administrative law judges and Department of Justice, department of Justice attorneys that defend the case. So in our situation, what we do is we are, licensed to practice before the US Court of Federal claims. There’s only one court in the whole world that deals with these injuries, and if somebody has, let’s say, a flu vaccine.

And they have certain injuries, within a certain number of days, and they last for a certain period of time, then the case is compensable. And it’s kind of that simple. You have to gather all the information, make sure you have proof that this is the case. And if you don’t have your proof, then you’re not gonna, not gonna get your compensation.

So there are no gray areas with that. It’s gotta be pretty black and white. Yeah. And I, I have to imagine that it is extraordinarily difficult to prove and I, I learned it for, like I said, from the one client of mine who had a tetanus shot and was really beginning to show signs a few months later that, you know, going to his doctor, he is having nervous, you know, nerve issues and stuff like that.

Nobody could figure it out. Until someone threw out this could be a vaccine industry. And behold it again, he never heard of it. I’ve never heard of it. And, you know, so my understanding too, to your point that part of the reason why this was done, and please correct me if I’m wrong, Jon, was that they wanted a lot of the pharmaceuticals were concerned about being liable for the vaccines and the government stepped in and said, Hey.

You know, hey, Mr. Pharmaceutical, we are gonna make it so that you are not liable. We, as the government is going to take on that liability. Correct? Yeah. So, so the pharmaceutical companies, that’s why they put the money into this fund. And then, the pharmaceutical company is, I wanna say off the hook, but they’re not, they’re not the ones that are getting sued or they’re not the ones paying out the claims.

It’s the fund that is paying out the claim. And, and the claim that’s paid, there are different levels, I’ll call it. You know, there are table claims, meaning it’s one that you meet certain elements and then you’re gonna get compensation because you’ve met those elements. There are other claims that are off the table, and those are ones, you know, kind of like your tetanus shot where you have a doctor that says, yes, this shot caused these injuries.

And if you have a doctor that says that, and if the federal government has a doctor that disputes it. Then there’s a judge who will decide which side is correct, and then if your doctor wins the day, then the fund is gonna pay for not only your lost wages and your pain and suffering and those kind of things, but also separately will pay for all the attorney’s fees.

Oh, really? You don’t, it’s not contingency. Because you get your compensation and then attorneys, what we have to do is we have to keep our time, we have to bill our time, and then after the client gets their money, we have to submit our time to the fund. And then the federal government looks over our time to make sure we were reasonable, and then the fund pays us separately.

So it is really, it’s a good program in that. The client gets all the money they are supposed to get. That that’s unlike a car crash with a car accident. You know, attorneys get paid a contingency fee or a portion of the limits. So let’s say the limits are a hundred thousand dollars, I’m gonna get $33,000 and the client gets the rest with the vaccine program case, if the limits are a hundred thousand, or sorry, if the payout’s a hundred thousand, there are no limits.

If the payout’s a hundred thousand, the client’s getting a hundred thousand, right? But now the attorney gets. Separate funds. The but from your, looking at it from a business perspective, and we’re running low on time, I wanna get to the elder abuse. But from the business perspective, do you take on that case?

Because if there’s risk of you losing, does the client pay you? No, the federal government does. But if the client loses, if you don’t win the case, does that mean you just don’t get paid? Or does the client pay? If we don’t win the case and we have a reasonable basis for our beliefs, and we had a doctor who said, we can petition the fund to pay us and the majority of the time we get paid, win, lose, or draw.

Oh really? That’s interesting. Okay. Very interesting. It’s a fascinating, again, I didn’t know it existed. It’s, and there are not many lawyers in the nation who do this. You know, we have clients who are international, we have clients who are in Europe, who are in Siberia. If, if you get a vaccine at any, US military base, you’re in the program.

Interesting. So, lastly, and I don’t wanna miss this one. You deal with elder abuse. Yes. That is a very, very sensitive topic, particularly in the financial world, albeit I, I believe that it should be because the government is protective of, I hate to use the word 65 as elder. because there’s a lot of people who will shoot me because a lot of people are 65, but they determine that as anybody, they, the government tries to protect you, which I think they should. First of all, I think the government should keep the heck out, but separately, too much elder abuse in the financial services industry taking advantage. But I think the elder abuse that you’re talking about is not as much on the financial side as it is like in nursing homes.

Could you elaborate, please? Sure. And, the number one thing we see with elder abuse cases or nursing home abuse cases is where a nursing home is understaffed. So when you’re looking for a nursing home, there are programs you can go with the, you know, the STAR system and look online, Medicare and the federal government has a, a rating system for nursing homes, whether there, there are complaints, there are. Every state has an agency that, that has to investigate or has to just monitor nursing homes. So you can go to that nursing home or go to the agency and then check your nursing home to see if they are a good nursing home, I’ll say.

But most of the time what we’re looking at is understaffing because it’s a for-profit business maybe. And if it’s a four, five business, they’re gonna save money by having fewer staff or not qualified staff. And the cases that we see are where somebody is left alone for too long and something bad happens.

I mean, I’ve had cases just sad cases where somebody is left alone in the shower or left alone on the toilets. Wow. And left alone for long periods of time where your legs go numb and you fall over and the worst case scenario happens. Yeah. We don’t wanna know and just go, those situations can easily be fixed.

If you had an additional just a CNA or somebody who is the assistant to the assistant checking on individuals in a nursing home. Yeah. But that’s the number one thing that we see. Well, that’s sad. Jon, you know what, this episode just blew right by. You’ve been very informative. Wow. Yeah.

Only wish. Thank you for having me. Oh, it’s been a pleasure. You know, you had sent over a thing to put up with your contact information. Unfortunately, apparently there was too much stuff jammed into it. So what I’d like you to do is slowly. Tell people how they can get ahold of you, your phone number, or your website or what have you.

Please do good. Thank you. It’s really easy. It’s grothlawfirm.com, G-R-O-T-H law firm.com. Jonathan Groth. If you Google Jonathan Groth attorney in Wisconsin, you’ll find me, the number that you can call or you can text. It’s 4 1 4 9 9 9 0 0 0 0. So it’s pretty easy. Four number 4, 9 9 0 0 0, 0.

Excellent. Jon, thank you very much. This was just fascinating. I learned so much and you had a list of a whole bunch of things to talk about and we only got to a few of them, but you know this, to tie this into financial planning, Jon brought up a lot of valuable points, particularly as it pertains to we didn’t get into it, but you know, if you’re ever injured, you really need to think very quickly.

As to whether or not it is an actionable offense, because there are steps that need to be done very early on. But more importantly, one of the things that I got out of this mostly as it pertains to the financial planning again, is do not underestimate the insurance coverage that you have through automobile insurance.

A lot of people try to skimp out to get their automobile insurance coverage. It, the prices are down. You know, I could save you money on automobile insurance. Well, how did they save you the money? Not because the insurance is better, but because they cut your insurance coverage and next thing you know.

You’re in the Hurt Locker. So you know, that is certainly one of the takeaways is make sure that you’re adequately insured. Jon, thank you very much. I appreciate you being on the show today. Very informative. I wish you a wonderful day and for everyone who is watching, I hope all of the viewers learn something today.

And thank you for joining us and signing off today. Mike Menninger, certified financial planner from Financial Planning Explained, look forward to seeing you for the next episode. Thank you.